Planning a trip to Morocco means getting ready for a mix of old and new. Morocco is famous for its lively culture and deep history. Knowing how to pay for things is key to enjoying your trip.

In big cities like Marrakech and Rabat, you can use modern ways to pay. But, in traditional souks and rural spots, cash is king.

Learning how to use Credit Cards in Morocco and ATMs will enhance your trip. It helps you navigate both traditional and modern systems, ensuring a smooth and enjoyable experience.

Key Takeaways

- Major cities in Morocco accept modern payment methods.

- Traditional areas rely on cash transactions.

- Knowing about ATMs and credit cards is important.

- Being prepared makes your trip better.

- Morocco is a unique mix of modern and traditional.

Understanding Morocco‘s Payment Landscape

Traveling to Morocco means knowing how to pay for things. The country uses both old and new ways to pay.

Cash vs. Electronic Payments in Morocco

Cash is the top choice for paying in Morocco, used in over 70% of transactions. But, electronic payments are becoming more common, mainly in cities.

Prevalence of Cash in Daily Transactions

Cash is the favorite for small buys and daily needs. It’s best to carry cash, too, for markets and street food.

Electronic Payment Growth in Urban Areas

In cities like Marrakech and Casablanca, more places accept cards. This makes it easier for visitors to pay without lots of cash.

Payment Trends in Morocco

The trend is shifting towards digital payments, but cash is also big. Knowing both helps manage your money better on your trip.

Prevalence of Cash in Daily Transactions

It’s wise to have some Moroccan dirhams for everyday buys. You can get money changed at the airport or from ATMs.

Electronic Payment Growth in Urban Areas

In tourist spots and big cities, card and mobile payments are getting more popular. They offer a handy cash-free option.

Credit Cards in Morocco: What You Need to Know

Credit cards are handy for shopping in Morocco. Knowing where and how to use them is key. As you explore, knowing about credit card use can enhance your trip.

Major Card Networks Accepted

In Morocco, Visa and Mastercard are common in tourist spots and fancy places. These cards are widely accepted.

Visa and Mastercard Acceptance

Visa and Mastercard work well in Morocco, at hotels, restaurants, and shops for tourists. You’ll find them at big retailers and service providers. So, carrying a Visa or Mastercard is a good choice for secure purchases.

American Express and Discover Limitations

American Express and Discover are less common in Morocco. But, some big places and tourist spots might take them. For smaller shops or traditional sellers, it’s best to have cash or another card.

Where Credit Cards Are Commonly Accepted

Credit cards are accepted at places for tourists and business travelers. Knowing where to use them helps with planning and avoiding problems.

Hotels and Upscale Restaurants

Hotels, from mid-range to luxury, take major credit cards. Upscale restaurants in big cities like Marrakech and Casablanca also accept them. This makes paying for your stay and meals easy without cash.

Tourist Shops and Modern Retail

Tourist shops and modern stores take credit cards. This includes places for souvenirs, boutiques, and big retail chains. Using cards here is convenient and safe.

“Using credit cards can provide an additional layer of security and convenience when traveling abroad,” said a financial expert. “It’s essential to understand the local payment landscape to make the most of your credit card benefits.”

Places That Typically Require Cash

Even with more credit card use, cash is key in Morocco. Knowing where cash is needed helps with budgeting.

Traditional Markets and Souks

Souks are a big part of Moroccan culture. While some vendors take cards, many prefer cash. It’s wise to have dirhams for souks.

Small Businesses and Street Vendors

Small shops and street vendors usually want cash. For fresh produce or crafts, cash is best. It makes buying easier.

Finding and Using ATMs in Morocco

Planning a trip to Morocco? Knowing how to use ATMs safely is key. Morocco’s ATM network is well-developed, making it easy to get cash in big cities and towns.

ATM Availability in Major Cities

In Morocco’s big cities like Marrakech, Casablanca, and Rabat, ATMs are everywhere. You’ll find them in banks, shopping centers, and airports.

Bank Locations and Shopping Centers

Most banks have ATMs inside, and many shopping centers have their own. This makes it easy to get cash while shopping or eating out.

Airport and Hotel ATMs

Big airports like Marrakech Menara and Casablanca Mohammed V have ATMs. So do many hotels, which is great for getting cash when you arrive or during your stay.

Bank-Affiliated vs. Independent ATMs

In Morocco, you’ll see both bank-affiliated and independent ATMs. Knowing the difference can save you from extra fees.

Security Considerations

Bank-affiliated ATMs are safer, being inside banks or secure areas. Be careful with standalone ATMs, though, and avoid them at night.

Fee Differences

Independent ATMs might charge more for withdrawals. Using bank-affiliated ATMs can help you save money.

Step-by-Step Guide to ATM Withdrawals

Using an ATM in Morocco is easy. Here’s how to do it:

- Insert your card and select your language.

- Enter your PIN and choose the withdrawal option.

- Select the amount you want to withdraw, remembering daily limits.

- Take your cash and receipt, making sure you have your card back.

Language Options and Navigation

Most ATMs let you choose from several languages, including English. This makes it easier for tourists to use them.

Withdrawal Limits and Receipts

Know your daily withdrawal limits. Always take your receipt to keep track of your spending.

Preparing Your Cards Before Traveling to Morocco

To avoid any financial hiccups during your Moroccan adventure, prepare your cards in advance. Make sure your credit cards are ready for international use. This can save you from unexpected issues while abroad.

Notifying Your Bank of Travel Plans

Telling your bank about your travel plans is key. It prevents your card from being blocked due to suspicious activity. This simple step can make a big difference in your travel experience.

Preventing Card Blocks

By notifying your bank, you’re helping them understand that the transactions are legitimate. This reduces the risk of your card being flagged for fraud.

Setting Up Travel Notifications

Most banks offer travel notification services through their mobile apps or online banking platforms. Use this feature to ensure uninterrupted access to your funds.

Checking Card Expiration Dates

Before traveling, check that your credit cards are not nearing expiration. Using an expired card can lead to embarrassing situations and possible financial losses.

Timing Considerations

Check the expiration date well in advance. This allows time for a replacement card if needed. Some issuers may take a few weeks to deliver a new card.

Backup Payment Methods

It’s always a good idea to have a backup payment method. This could be a secondary credit card or debit card. It ensures you have access to funds in case your primary card is compromised.

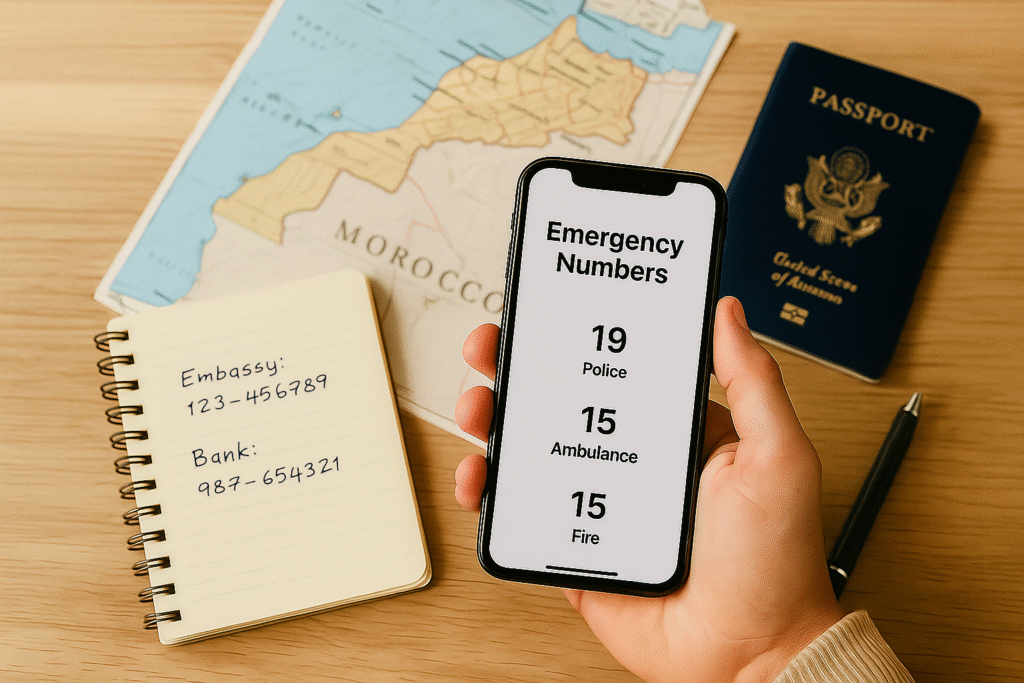

Saving Emergency Contact Numbers

In case your card is lost, stolen, or blocked, having emergency contact numbers is vital. It can be a lifesaver.

Bank Customer Service Contacts

Save the customer service numbers of your card issuers in your phone or keep them written down in a safe place.

Local Embassy Information

Also, note down the contact information of your local embassy in Morocco. They can provide assistance in case of an emergency.

| Task | Action | Benefit |

|---|---|---|

| Notify Bank | Inform bank of travel plans | Prevents card blocks |

| Check Expiration | Verify card expiration date | Avoids declined transactions |

| Save Contacts | Save bank and embassy contacts | Assistance in emergencies |

Security Tips for Card Usage in Morocco

Traveling to Morocco means being careful with your credit and debit cards. Knowing how to protect your money is key. This way, you can enjoy your trip without worrying about fraud.

Preventing Card Fraud and Theft

To avoid card fraud, keep your cards safe and be smart online. Here’s how:

Physical Card Protection

Always keep your cards in a safe spot. Use a money belt or a secure wallet. Be careful when using ATMs or making purchases.

Digital Security Measures

Be careful with public Wi-Fi for transactions. Use a VPN for safety. Check your account often for any odd activity.

What to Do If Your Card Is Lost or Stolen

If your card goes missing, act fast to limit damage.

Immediate Steps to Take

Call your bank right away if your card is lost or stolen. Most banks have a 24-hour hotline. You can also freeze your card if you think it’s been taken.

Replacement Card Options

Find out how your bank handles lost or stolen cards abroad. Some offer fast replacements for a fee.

Using Secure Payment Methods

Morocco uses chip and PIN and contactless payments. Knowing these can make your transactions safer.

Chip and PIN Transactions

Chip and PIN transactions are safe because they need a PIN. Make sure your card supports this.

Contactless Payment Safety

Contactless payments are easy and safe, using encryption. But, watch your limits and check your statements.

| Security Measure | Description | Benefit |

|---|---|---|

| Physical Card Protection | Using a money belt or secure wallet | Reduces risk of card theft |

| Digital Security | Using VPN on public Wi-Fi | Secures internet transactions |

| Chip and PIN | Using cards with chip and PIN technology | Adds an extra layer of security |

By following these tips, you can greatly reduce fraud risks. Enjoy a safe and worry-free trip in Morocco.

Understanding Fees and Charges

Using credit cards and ATMs in Morocco can lead to unexpected costs. Knowing about these fees helps you manage your money better while traveling.

Common ATM Withdrawal Fees

ATM fees are a big deal when you’re abroad. These fees come from your bank and the local bank’s ATM.

Home Bank Charges

Your bank might charge a fee for using ATMs outside your country. This fee could be a flat rate or a percentage of what you withdraw.

Local Bank Surcharges

The ATM’s bank might also charge a fee. These fees can change a lot depending on the bank and location.

| Bank | Home Bank Charge | Local Bank Surcharge | Total Fee |

|---|---|---|---|

| Bank A | $2.50 | $3.00 | $5.50 |

| Bank B | 2% | $2.00 | Varies |

Foreign Transaction Fees Explained

Foreign transaction fees are another thing to think about in Morocco. These fees come from your credit card company.

Percentage-Based vs. Flat Fees

Some cards charge a percentage on each transaction. Others charge a flat fee per transaction.

Hidden Fee Considerations

There are other fees too, like for cash advances or converting currency.

Currency Conversion Costs

Converting currency when you buy something or withdraw cash can cost you.

Bank Exchange Rates

Your bank or credit card issuer uses their own rate for currency conversion. This rate might not be the best one.

Avoiding Dynamic Currency Conversion

Watch out for dynamic currency conversion (DCC) from merchants. DCC lets merchants convert your money at their rate, which is often worse.

By knowing about these fees and how to avoid them, you can save money in Morocco.

Best Credit Card Options for Morocco Travel

Traveling to Morocco requires the right credit card. Morocco has a mix of old and new, with many payment options. But, not all credit cards are good for international trips.

Cards with No Foreign Transaction Fees

Using a credit card with no foreign transaction fees can save you money. These fees can add up fast. So, avoiding them can really help your budget.

Travel-Focused Credit Cards

Travel cards are made for travelers. They have no foreign transaction fees, travel insurance, and rewards for travel. The Chase Sapphire Preferred is a favorite among travelers.

Premium Banking Options

Premium cards, like the American Express Platinum, offer top benefits. These include travel insurance, lounge access, and concierge services. They cost more but are great for those who travel a lot.

Travel Rewards Cards for Morocco

Travel rewards cards are great for Morocco. They give points or miles for flights, hotels, and more.

Points and Miles Opportunities

Points or miles cards are very useful for Morocco. You can earn rewards for travel. The Capital One Venture card is a good example.

Travel Insurance Benefits

Many travel cards offer insurance. This protects against trip cancellations, interruptions, or delays. It’s very helpful when planning your trip.

Comparing Credit Card Benefits for Moroccan Travel

When choosing a card for Morocco, think about what’s important to you. Look at currency exchange rates and emergency services.

Currency Exchange Rate Benefits

Some cards have better exchange rates or benefits. These can help you save money on transactions. Look for these to get the most value.

Emergency Assistance Services

Cards with emergency services offer peace of mind. They help with lost cards, medical emergencies, or travel problems.

Alternatives to Credit Cards in Morocco

Credit cards are common in Morocco, but there are other ways to pay. These options are great for local vendors or rural areas. They offer convenience and security.

Prepaid Travel Cards

Prepaid travel cards are a good choice. You can load them with local or multiple currencies. They’re perfect for managing your money.

Loading and Reloading Options

You can add money to these cards before or during your trip. Many offer online or app reloading for easy access.

Advantages for Budget Management

Prepaid cards help you stick to your budget. You can only spend what you’ve loaded. This is great for those who like to budget.

Mobile Payment Options

Mobile payments are getting popular in Morocco. They’re easy and contactless, making them convenient.

International Mobile Wallets

Apple Pay and Google Pay are accepted in many places. They add an extra layer of security, as you don’t need to show your card.

Local Payment Apps

Local apps are also becoming popular. They offer services specific to Morocco. You can use them for shopping and dining.

Traveler’s Checks and Money Transfers

If you prefer old-school methods, traveler’s checks and money transfers are available. They’re good for emergencies or when you need cash.

Western Union and MoneyGram Services

Western Union and MoneyGram are trusted for secure money transfers. They’re handy for emergencies or when you need cash fast.

Emergency Fund Access

These services also let you access emergency funds. If you need money quickly, they’re a reliable choice.

| Payment Method | Convenience | Security |

|---|---|---|

| Prepaid Travel Cards | High | Medium |

| Mobile Payment Options | High | High |

| Traveler’s Checks | Medium | High |

Conclusion: Making the Most of Your Money in Morocco

Planning your trip to Morocco? It’s key to know how money works there for a smooth trip. Learning about credit cards and ATMs can help you use your money wisely.

Choosing the right credit cards and understanding fees can save you money. Knowing about ATM fees and foreign transaction costs is important. Also, having prepaid cards or mobile payments can make your trip even better.

Being ready and informed lets you enjoy Morocco’s culture, landscapes, and history without money worries. Whether you’re in the souks or a riad, a smooth financial experience means more fun and memories.